working capital funding gap calculation

The days working capital is calculated by 200000 or working capital x 365 10000000 Days working capital 73 days However if the company made 12 million in. Equation for calculate funding gap is Funding Gap Adequacy Goal - Current Spending.

Working Capital Gap Ratio Analysis Series Video No 12 Youtube

This information is needed to determine whether an.

. Improve operational efficiencies and reduce risk in the supply chain contact us today. Ad Existing SCF program not working as well as expected. It is calculated as the ending receivables balance divided by sales for the reported period multiplied by the number of days the sales represent.

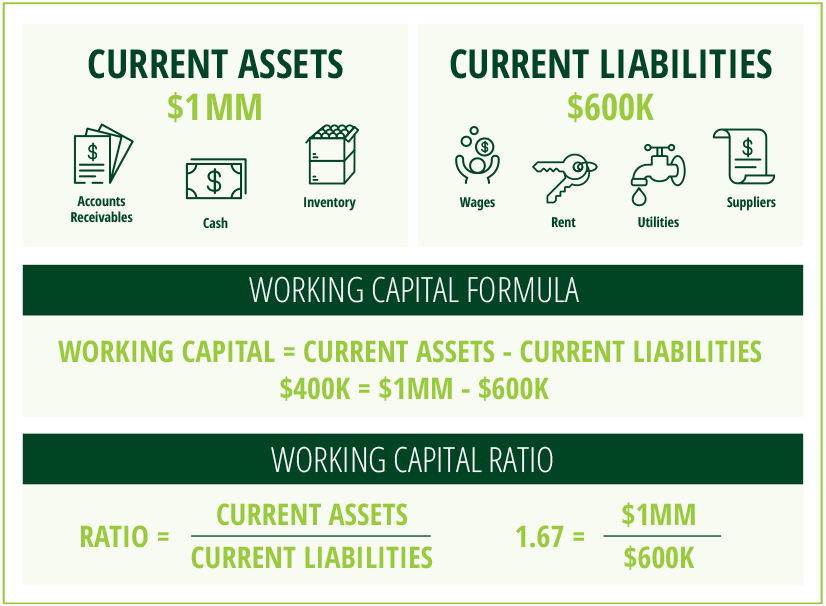

Working capital tells you if a company can pay its short-term. Working capital is calculated by subtracting a companys current liabilities from current assets. Often the number of days is 365.

The most transparent and efficient way to model working capital in a cash flow model is to calculate per period working capital adjustments. Working capital is typically forecast using historical working capital items as. Improve operational efficiencies and reduce risk in the supply chain contact us today.

WCR Inventory Accounts Receivable Accounts Payable. Working capital permanent capital fixed assets Here are more details to help you better understand the calculation above. Our next step is to forecast working capital on the balance sheet.

Working capital shows how much the current assets exceed current liabilities. Permanent capital equity long-term. Working Capital Finance Quick facts Amount From 500 to 50m Term 1-3 years depending on product type lender and agreement Cost Varies according to product lender and in some.

To calculate working capital open your balance sheet subtract total current li. Working Capital Cycle Inventory Days Receivable Days Payable Days. Logically the working capital requirement calculation can be done via the following formula.

Ad Existing SCF program not working as well as expected. The working capital cycle formula is as follows. The cash gap is the number of days between a businesss payment of cash for goods and services bought and the receipt of cash from its customers for goods or services sold.

Working capital analysis is used to determine the liquidity and sufficiency of current assets in comparison to current liabilities. See what Taulia can do for you today. The calculation of Rs.

Lets plug the above example into the formula to. The Working Capital Cycle for a business is the length of time it takes to convert net working capital current assets less current liabilities all into cash. See what Taulia can do for you today.

75000 is based upon the selling price whereas the actual funds locked up in receivables are restricted to the cost of goods sold only. The debtors adjustment is the.

Credit Analyst How We Calculate Working Capital Funding Gap The Wcfg The Period Between Company Pays For Inventory Cash Out And Company S Customers Pays For Goods Cash In طريقة الحساب

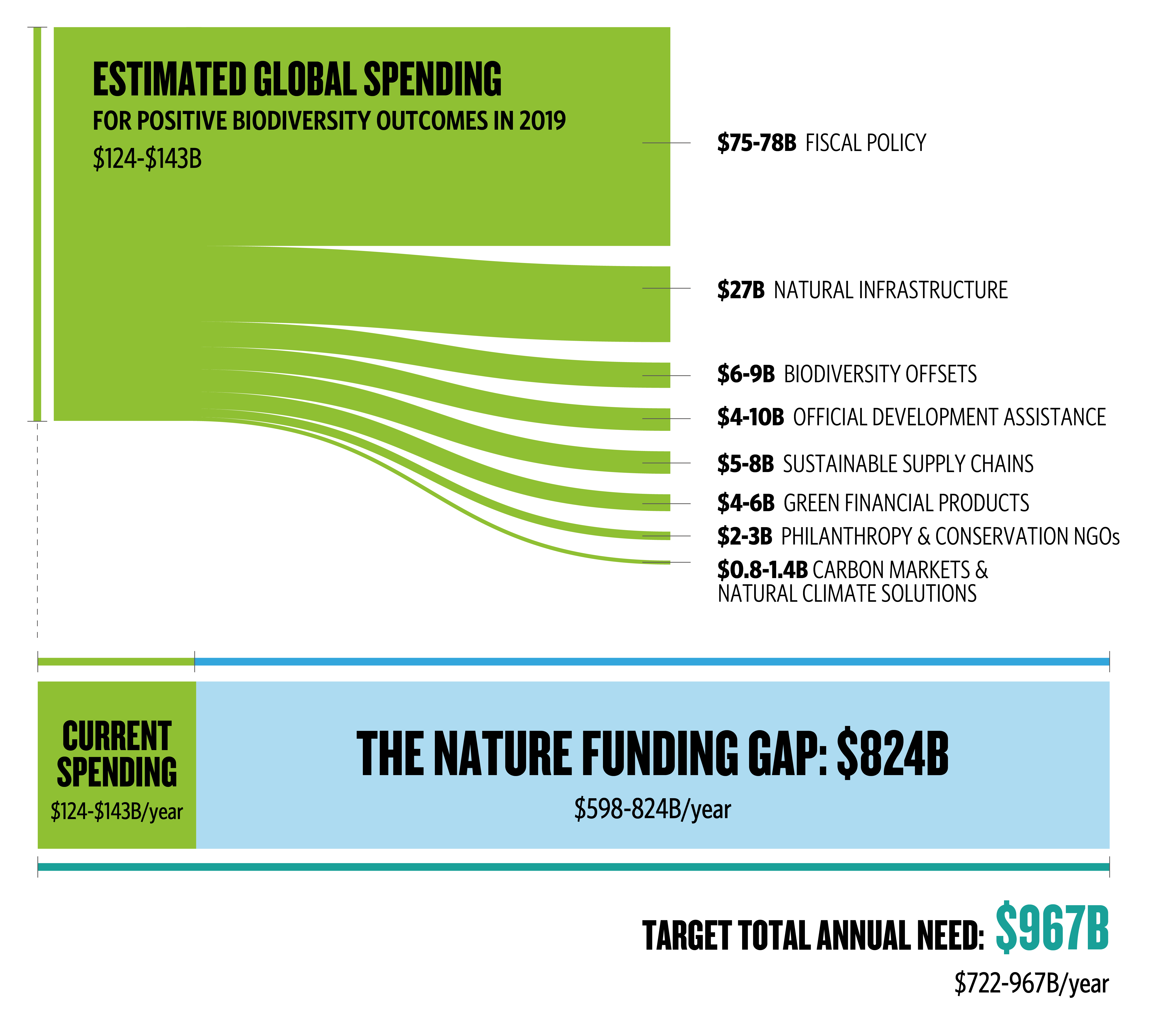

Closing The Nature Funding Gap The Nature Conservancy

Net Working Capital Nwc Explained Youtube

Solved When Calculating The Quick Ratio Or Acid Test Which Chegg Com

Working Capital Formula How To Calculate Working Capital

Working Capital Funding Gap Problem Water Cooler Analystforum

How Early Payments Increase Your Working Capital Tradeshift

How To Determine Your Company S Cash Conversion Cycle

Net Working Capital Guide Examples And Impact On Cash Flow

How To Calculate Working Capital Requirement Plan Projections

Working Capital Formula And Calculation

Working Capital Financing Options Catalyst Financial Company

/dotdash_Final_How_Do_You_Calculate_Working_Capital_Aug_2020-01-a35d03d74be84f8aa3ad4c26650142f6.jpg)

How Do You Calculate Working Capital

/dotdash_Final_What_Changes_in_Working_Capital_Impact_Cash_Flow_Sep_2020-01-13de858aa25b4c5389427b3f49bef9bc.jpg)

What Changes In Working Capital Impact Cash Flow

Working Capital Definition Formula And Examples

Days Working Capital Formula Calculate Example Investor S Analysis

Working Capital Cycle Understanding The Working Capital Cycle

How To Calculate Working Capital Requirement Plan Projections